$1,300 Ford Motor Trade

Core Idea: Sell cash-secured puts → collect premium → repeat if expires worthless → sell covered calls if assigned shares. Always pick strikes where you'd truly be okay owning 100 shares ($1,300 max risk). None of this matters if you don't find anything interesting because this requires habit, patience and a little bit of passion. You are buying insurance to mitigate other people's risk.

I think if you are brand new to all this, and re-read everything twice over, you should understand. I also think, if you just scroll down and look for pretty pictures, nothing will really be understood. 😅😂

The Nipple

- You only need stocks in the $8–$18 range (so 1 contract = $800–$1,800 capital). Everything else (high OI, good liquidity, decent premium) is already solved by the 0.16–0.22 delta rule inside TOS.

- Yes, you can trade the wheel strategy inside tax-advantaged accounts like Roth IRAs and 401(k)s (if self-directed), but with significant restrictions that limit the full strategy compared to a taxable brokerage.

- Backdoor Roth conversion is a strategy used by high-income individuals who exceed Roth IRA income contribution limits.

- Your option premium losses can indeed mitigate taxable gains through tax-loss harvesting, reducing your overall tax bill by offsetting other capital gains or up to $3,000 of ordinary income annually. This can smooth out your tax burden somewhat but doesn’t eliminate taxes altogether.

No – prop firms, hedge funds, banks do not hire people to run simple cash-secured put / covered-call wheels. They want high-frequency, spreads, volatility arbitrage, market-making, etc. The wheel is an excellent personal income strategy, but it is considered “retail grandma stuff” on trading floors. You can make very good money with it forever, but it won’t land you a professional trading desk job.

- OI = total number of open contracts still existing for that exact strike/expiry across all brokers.

- Just always sell puts that show –0.16 to –0.22 delta, slap the same OCO on them, and repeat. That’s it.

- Run real money with 1 or 2 contracts using the 0.16 – 0.22 delta rule for 20 – 30 trades. You will see for yourself:

- 80%+ close automatically for full or near-full profit

- <5% ever get assigned (and when they do, you still make money selling calls)

- The 0.16–0.22 delta band is the “goldilocks” zone because:

- Probability of the put finishing ITM ≈ 16 – 22% → you win ~80% of the time outright

- When you do get assigned (rare), you’re only ~3 to 8% underwater – easy to sell calls and get out profitably

- Premium is high enough to compound fast without babysitting

2 wheel mental checklist

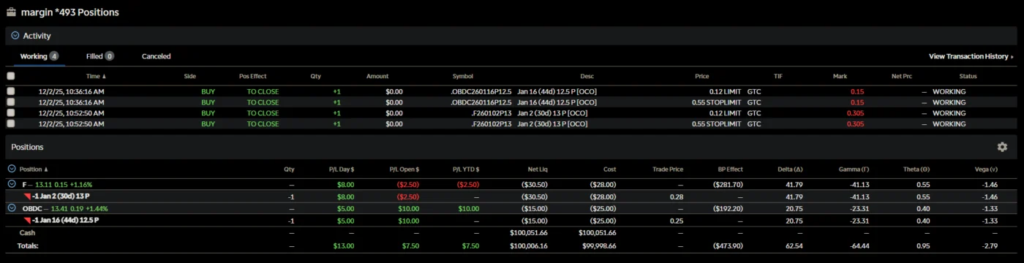

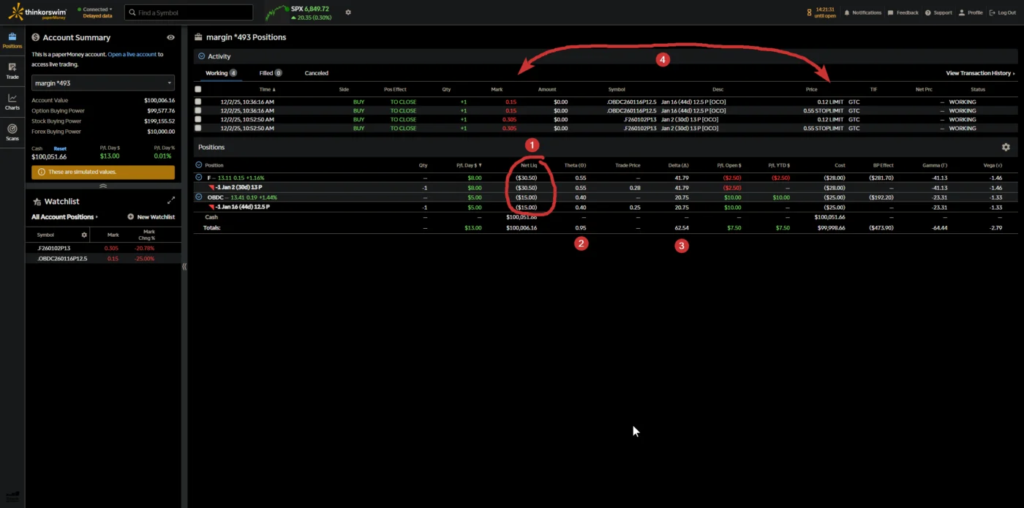

- Are all 4 OCO legs working?

- Net Liq column → “How much cash has the wheel already paid me?”

- Mark column → “How close am I to the 0.12 profit leg?”

- Theta column → “How fast is time working for me?”

- Delta column → “Am I still in the 0.16–0.22 sweet spot?”

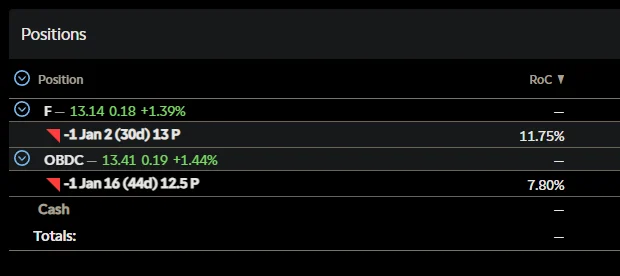

- RoC column → “Is this still one of the best-paying wheels I could have?”

Any red flag (missing leg, theta negative, delta >0.35, etc.) means you ONLY THEN think about rolling or closing.

- 4 OCO legs working → yes

- Net Liq → –$45.50 total → +$45.50 cash collected

- Mark vs 0.12 profit leg → OBDC 0.175 (0.055 away), Ford 0.285 (0.165 away) → both closing soon

- Theta → +$1.24/day → machine running strong

- Delta → –0.25 (Ford), –0.18 (OBDC) → still sweet spot

- RoC → 9.6–11.2% annualized → excellent

Example #1 ⟶ Applied Training

Officially running the wheel like a 10-year veteran?? This is exactly what “set-and-forget” looks like in real life.

- You are up $45.50 cash collected

- Theta is making you ~$0.95/day combined

- 85–90% chance both disappear automatically in 7–21 days with ~$40–$50 total profit

- Worst case: one gets assigned → you own 100 shares ~5–8% below spot and start selling calls → still profitable

- The cash you already pocketed. Real money gains.

- Theta = making you ~$0.95/day combined

- Delta = Risk = –0.19 / –0.24 → both in the 0.16–0.22 sweet spot → perfect

- Mark vs OCO legs (this is how you know when it will close)

- Your profit leg = 0.12 → still needs to drop another 0.185 before auto-close

- Your stop leg = 0.55 → needs to rise 0.245 before defense triggers

- Profit leg = 0.12 → only needs to drop another 0.03 → will likely close in the next few days

Most wheelers just use Net Liq (original premium) + P/L Open $ side-by-side and mentally add them to get exact dollars already made.… Realized + Theta

What does it look like when things are going?

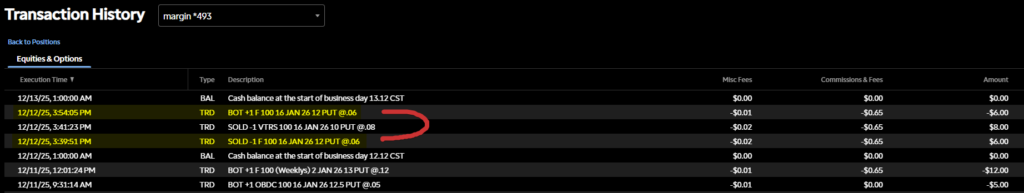

Two wheels just finished perfectly and paid cash. $36 cash added today is extra money on top of the original premiums. This is the magic of the wheel: you get paid twice on every trade. 1st when you sell, 2nd when the profit leg closes early.

- Profit legs triggered automatically – Total ~$36 cash added today.

- Ford closed @0.12 → $16 profit locked

- OBDC closed @0.05 → $20 profit locked

- Both wheels fully complete. Capital freed (~$2,550 buying power back… two wheels)

What “Profit Leg Trigger” Means

Imagine you sold someone insurance for $28 and said, “If it ever costs only $12 to buy it back, buy it back for me automatically.”

- Today the insurance dropped to $12 (Ford) and $5 (OBDC).

- Your robot (the GTC order) instantly bought it back.

- You keep the difference → free money.

This is EXACTLY what you want to see every single time you wheel trade.

What's next??

- Smile — you just made $51.66 with zero work.

- REAL Withdraw: ~$38.75 after 25% tax (~$12.91 tax) for burritos.

- Open your watchlist

- Pick ONE stock → go to option chain → sell a 30–45 day put with –0.16 to –0.22 delta

- Immediately set the same OCO (0.12 profit leg + 0.55/0.60 stop leg)

- Repeat in 2–3 weeks

- TIPS

- Diversify sectors for risk spread.

- Rotate to avoid over-concentration.

- Visit websites of stock and just see and browse if you like what you see…

Timeline / Summarize

- Day 0: Sold put → collected $28 premium instantly

- Days 1–11: Theta ate $25 of the put's value → you were up $53 unrealized

- Theta decay: Time value of options erodes as expiration nears.

- Why exists: Options expire worthless if unused; closer to expiry, less time for stock to move favorably → value drops.

- Today: Put decayed to $0.12 → bought it back for $12 → +$16 locked in

- Final profit: $28 premium + $25 theta – $12 buyback = $41 total (minus $1.30 fees = $39.70 net)

The stop leg (buy-to-close) does not assigns shares. You are not assigned shares. Stop leg almost always prevents assignment (closes put early for small loss).

But What If? Opposite Approach.

- Stop leg hits → small $35 loss, walk away.

- Assigned → own 100 shares at effective $12.70 (strike minus premium).

- Sell monthly calls on shares → collect more premium until shares called away higher → still profit overall.

- Pick OTM strike 5-10% above current price (above $12.70 to profit).

- Set OCO: Limit sell-to-close call @0.12 GTC (profit); Stop @0.55/0.60 GTC (defense).

- Mitigate fees/commissions: Aim 3-5% above cost basis to cover (~$0.65/contract). Premium offsets rest.

Example #2 ⟶ Setup 3 Wheels

- Good sells (WU $8 @0.22, VTRS $10 @0.28, F $12 @0.28; all ~0.18–0.22 delta).

- Premiums collected: $78 gross (~$75 net after fees).

- OCO legs for each (set after fill) – Some brokerage require sell-to-open put to fill first (creates short position) before you can attach OCO.

- WU Jan 16 $8 P: Buy @0.12 LIMIT GTC + Buy @0.55 STOP → 0.60 LIMIT GTC

- VTRS Jan 16 $10 P: Buy @0.12 LIMIT GTC + Buy @0.55 STOP → 0.60 LIMIT GTC

- F Jan 16 $12 P: Buy @0.12 LIMIT GTC + Buy @0.55 STOP → 0.60 LIMIT GTC

- END RESULTS??

- 🔮 = OCO profit legs (@0.12): Expect +$12 + $16 + $16 = +$44 additional.

- Total expected profit: ~$119 (pre-tax).

- Days: 7–21 per wheel (average 14). All three ~2–3 weeks to close.

- END RESULT + PREVIOUS?

- +$119 profit from current 3 wheels + ~$89 from previous 2 = +$208 total profit so far.

- Leveraged ~$3,300 buying power (3 wheels) + previous ~$2,550 = ~$5,850 total risk for $208 profit (3.55% return on risked capital in ~2 weeks).

- 3.55% ROI in 14 days (92% annualized… BIG IF).

- S-tier vs. VOO's ~0.38% in same period (10% annual).

Example #3 ⟶ Not a rare “perfect storm”

In the wheel, you normally sell cash‑secured puts on a stock you want to own, collect premium, and either get assigned shares or the puts expire worthless, then repeat. Here, instead of waiting weeks for expiration, price action moved in my favor quickly, so the platform hit my auto OCO condition: one leg executed and the other canceled, letting me lock in profit in just a few hours!!

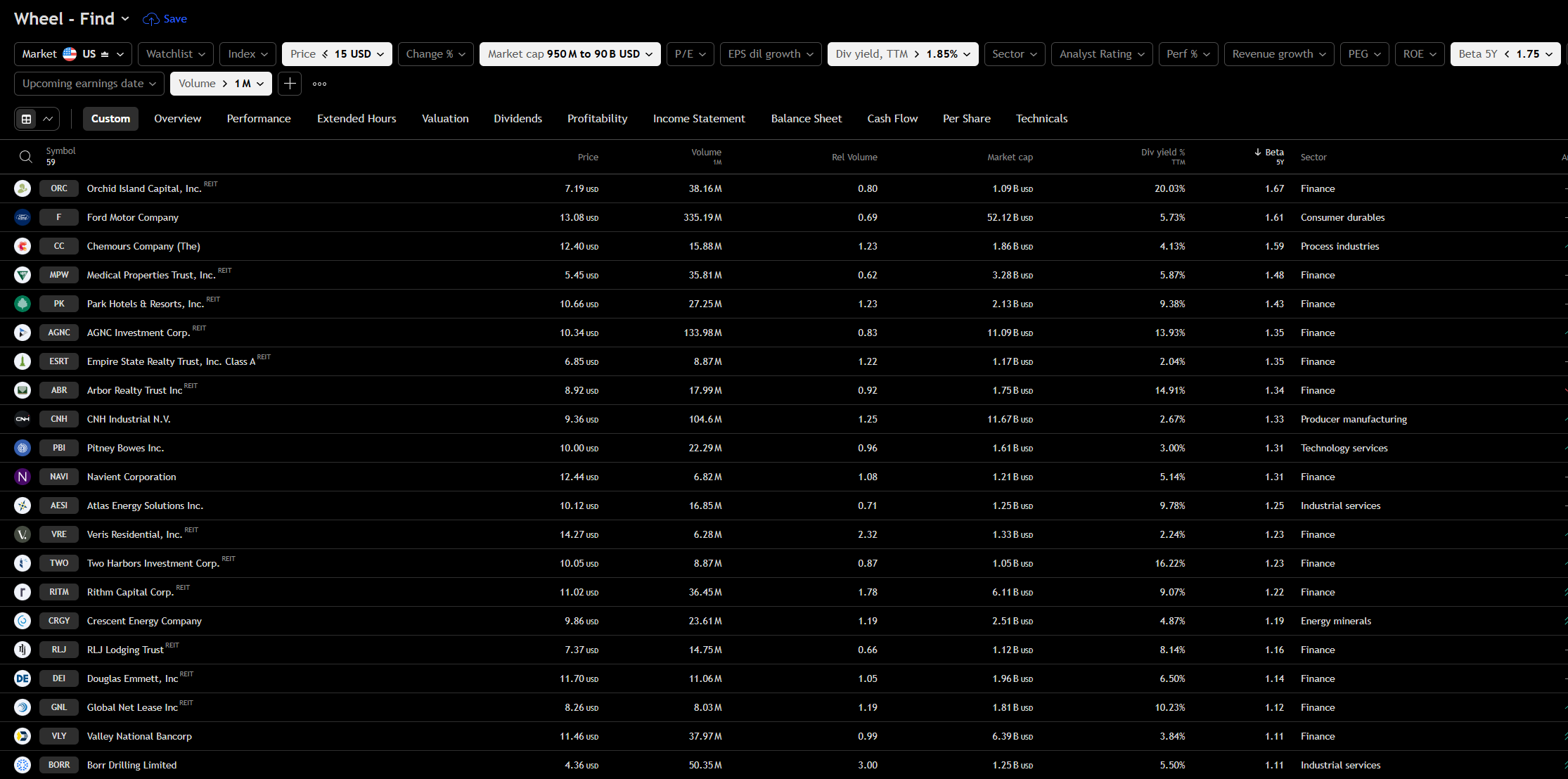

Export Screen Results on TradingView in MD or CSV!

How to export screener data in TradingView in markdown or excel format using a simple script in your browser.

Chart data export script for CSV/MD format data on the tradingview.com/screener/ website. Some people pay $34/mt for this VERY OWN feature!!

- Visit https://www.tradingview.com/pricing/?feature=Buy%20Trial

- Look for “Chart data export” under Plus

- https://www.tradingview.com/support/solutions/43000537255/

Once you reach age 59½, you can withdraw any amount. This rule exists to discourage people from spending their retirement savings too early.

WHY??

Research in behavioral economics and retirement savings shows many people struggle with saving adequately due to cognitive biases, lack of discipline, misunderstanding of compound interest, and underestimating how long money must last in retirement.

It's not a scam but a paternalistic tool – effective for most.

Take what you want to believe. I think it's a scam, but this is the way the game is designed. 😂 It is. What it is.

The idea is that people sometimes make choices that harm themselves, especially in complex areas like finance or health, so authorities step in to help prevent serious harm – even if it means restricting some immediate freedom.

- https://www.optionsplay.com/blogs/what-is-the-wheel-strategy-in-options-trading

- https://www.insiderfinance.io/options-profit-calculator/strategy/cash-secured-put

- https://optionalpha.com/blog/wheel-strategy

- https://www.optionstrading.org/blog/the-wheel-strategy-explained/

- https://tradingqna.com/t/can-option-prices-go-negative/105848

- https://steadyoptions.com/articles/wheel-strategy-options-master-wheel-trading-explained-r632/

- https://toslc.thinkorswim.com/center/howToTos/thinkManual/Monitor/Activity-and-Positions/Position-Statement

- https://www.youtube.com/watch?v=tPRt5GG0Yy0

- https://www.luxalgo.com/blog/wheel-strategy-options-cash-flow-playbook/

- https://www.tradingview.com/screener/jlbd1aex/ (pick decent stock)

- https://www.tradingview.com/script/E8zeTYik-Implied-Volatility-Suite/

- Mostly every brokerage can help you do Wheel Trading

- I like Think or Swim for paper trading, and Schwab is good platform but I would not recommend them or Fidelity, and especially not Robinhood.

- Paying premium for other tools is not worth it because this is SUPER SIMPLE basic stuff, no advanced analyst needed.

Practical, beginner-friendly with visuals/examples; emphasizes discipline/patience. High RoC goal (20%+) realistic for income.

This entire R&D started because I wanted to learn how to mitigate eating 3 chipotle burritos a week… so that means you need just under 6 wheels… more or less.

“Smaller max profit per contract BUT more consistent, is exactly what my 12–15 wheel trades per year goal is built around.”